By Michelle Diplock, RPP, MCIP, Manager of Planning and Government Relations, West End Home Builders’ Association

Opinion.

At the City of Burlington’s second Pipeline to Permit Committee meeting, members got to work on tackling the first “quick win” to address housing supply and affordability shortages in Burlington. The Committee adopted the following motion:

Direct the Acting Chief Financial Officer or designate to, at minimum, but not limited to consult with WE HBA and Marsh to explore and report back to the Pipeline to Permit Committee on how to implement a modern pay-on-demand surety bond program by the end of Q2 2024.

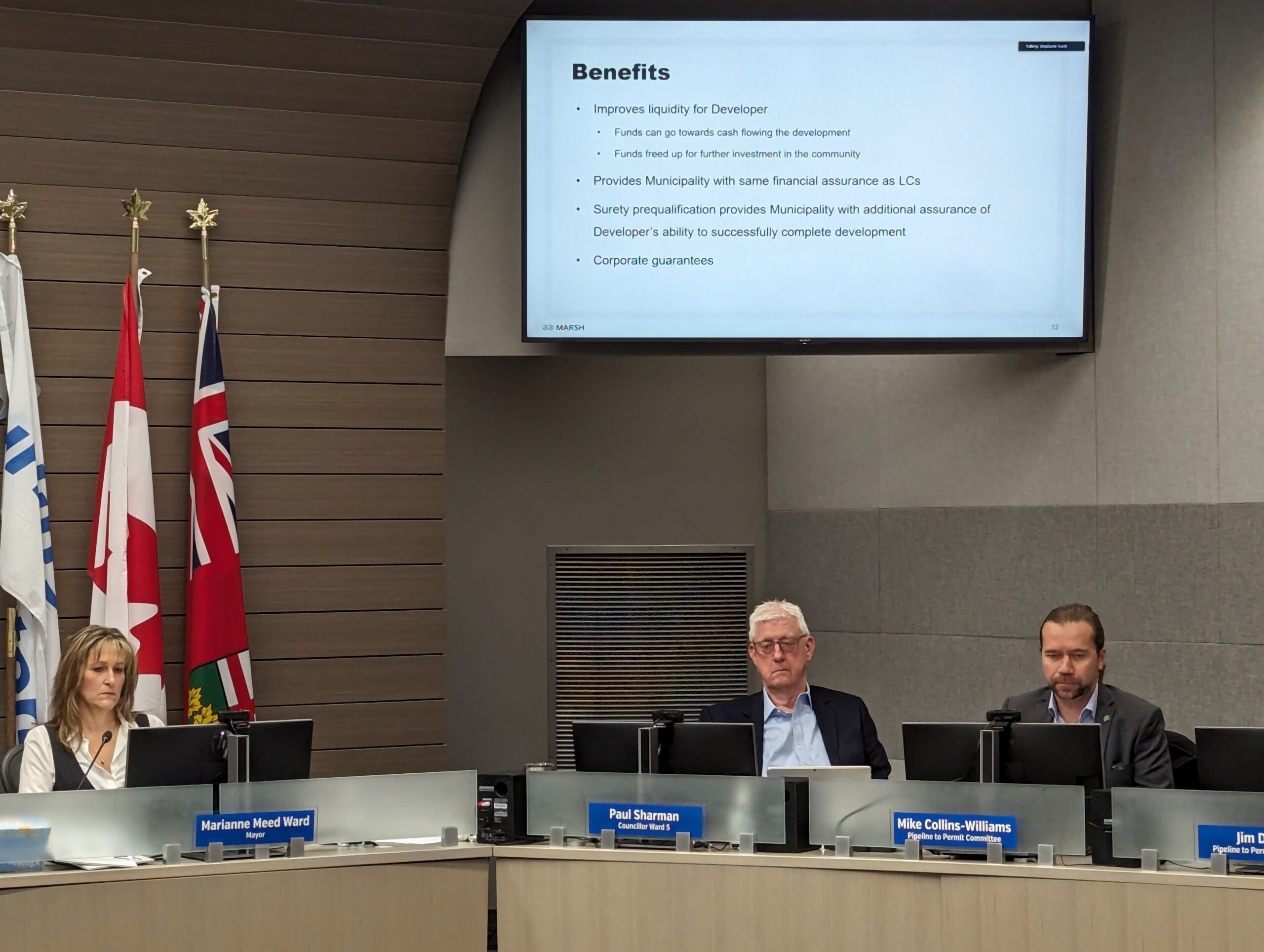

Surety bonds are an emerging financial tool being adopted across Ontario. Pay-on-demand surety bonds can unlock millions of dollars of private financial capital for re-investment in new infrastructure and housing projects. Last week, Marsh Canada’s Stephanie Kuntz and Brandon Kassies made a presentation to Burlington’s Pipeline to Permit Committee about the history and benefits of surety bonds and how developers and the city can work together using this new tool to encourage further housing investments in Burlington.

Several decades ago, it was somewhat common practice for municipalities to accept an older form of surety bond as security against development agreements, to ensure site work could be completed if the developer was unable to finish the project. In the 1980s, municipalities started opting for a more liquid form of security in letters of credit. Letters of credit are an effective form of security, but pose a significant downside to developers. Under letters of credit, banks require collateral from the developer, typically in cash, on a dollar-for-dollar basis. This cash is essentially held stagnant, rather than being used to fund the project at hand or used in further investment. This presents a liquidity crunch and opportunity cost for developers.

Industry stakeholders took on the challenge to create an alternative form of security that would still provide municipalities with financial protection without infringing upon developers’ liquidity. Bonds would allow for developers to procure an effective form of security on an off-balance sheet basis. This means bonds are secured by the developer’s corporate guarantee rather than cash, thereby relieving the strain on developers’ liquidity. At the same time, if an issue arises, municipalities are able to draw on the bond and are paid immediately by the surety bond provider.

The modern pay on demand surety system was first implemented in Calgary, in 2021. Marsh Canada sat down with the City of Calgary’s legal and finance teams to build a bonding system that mirrors the key features of letters of credit without compromising a developer’s liquidity or ability to reinvest cash into their next project. Since then, the West End Home Builders’ Association (WE HBA) has worked with Marsh Canada to bring the modern pay on demand surety system to Ontario, with Hamilton being the first large municipality to adopt bonds in 2021. After Hamilton, many other Ontario municipalities have adopted bonds, and WE HBA was pleased to bring Marsh to Burlington to provide their expert overview.

Members of council and the committee had a great dialogue with Marsh Canada about moving towards bonds in a way that protects the city’s interests and can help developers get more shovels in the ground faster. Although city finance staff initially summarized why construction bonds were not preferred historically, through Marsh’s presentation, staff gained a better understanding of how this modern form of surety bonds can work. The city is now prepared to explore the ways Burlington can implement surety bonds after discussions with WE HBA, Marsh Canada, and other municipalities’ legal and finance staff to ensure Burlington is protected from taking any financial risks, while moving forward with this exciting new financial tool.

To wrap up the discussion, committee members shared appreciative comments on how this new tool can positively affect the development industry and help Burlington meet their 29,000-unit targets, given the ongoing economic barriers to development. It was also acknowledged that this tool can benefit both market and non-profit developers alike and is a significant positive step forward that can help builders invest more in housing.

WE HBA was pleased to see the Pipeline to Permit Committee unanimously endorse this “quick win” for surety bonds, and we look forward to working with Marsh Canada, the City of Burlington, and our members to help Burlington realize their ambitious housing objectives.